Achieve PCI DSS 4.0 Compliance and

Strengthen Your Security Posture with Thales + Imperva

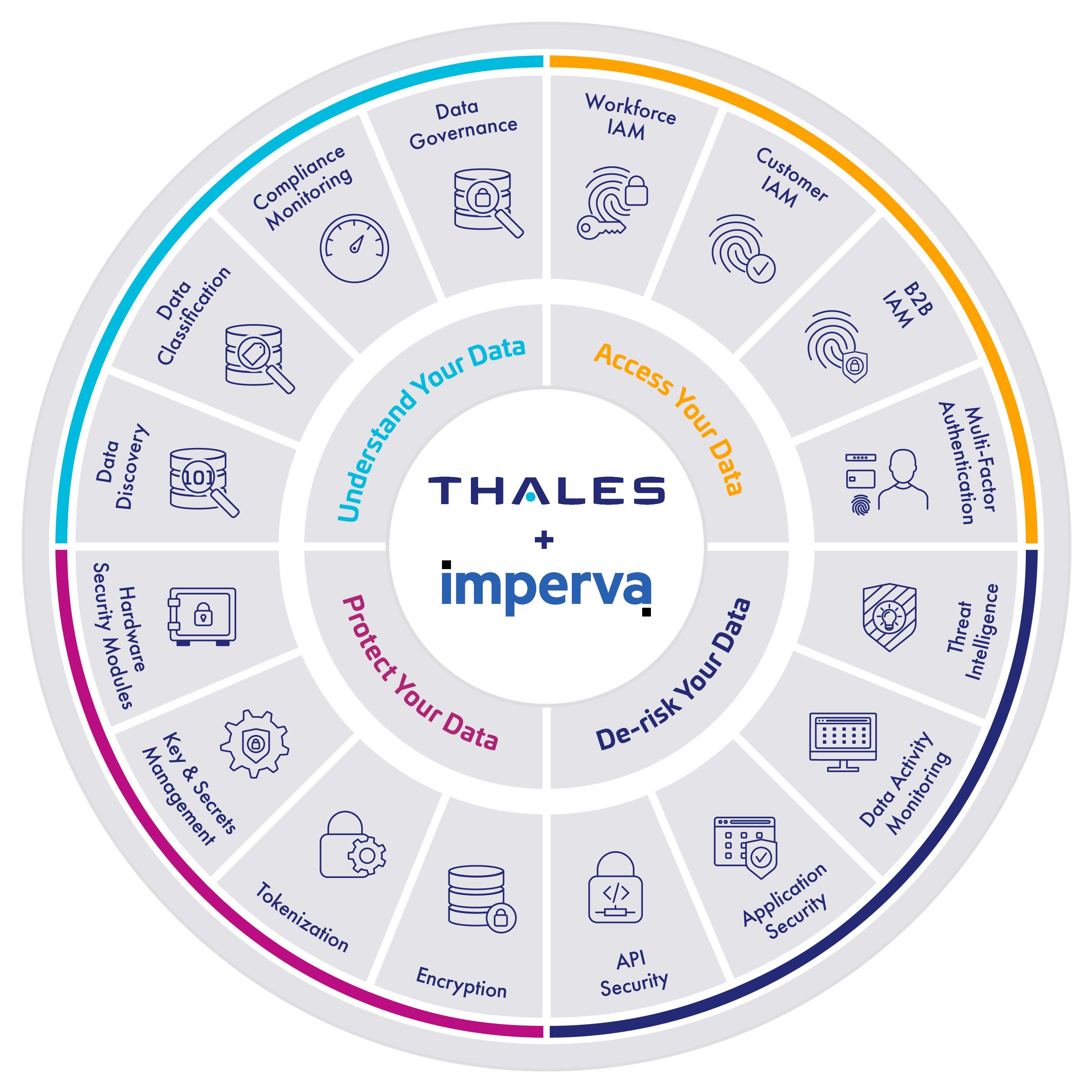

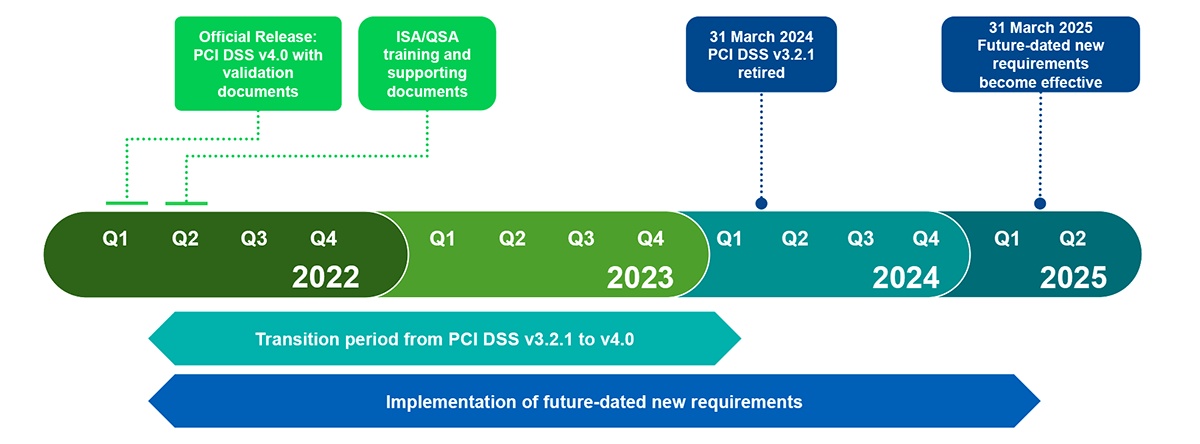

Digital transformation is raising security challenges for financial services, merchants, and online retailers. Advanced threats like malware, API breaches, and malicious bots, coupled with stricter regulations such as PCI DSS 4.0, demand robust defenses. To navigate PCI DSS 4.0 as it continues to evolve in line with the threat landscape, in addition to understanding the separation of duties between cloud providers and businesses and working within tight budget constraints, businesses need the right security strategy and approach. Together, Thales and Imperva simplify these challenges with tailored solutions, ensuring you stay ahead of threats and meet PCI DSS 4.0 regulatory requirements effectively before the 31st of March deadline strikes.

Identity and Access Management

Thales offers advanced identity and access management solutions, including multi-factor, biometric and context-based authentication with centralized compliance policy enforcement.

Client-Side Security and API Protection

Thales provides client-side and API security with real-time script monitoring, integrity checks, and WAF protection, reducing risks and streamlining compliance.

Data Security and Key Management

Thales ensures robust encryption and key management for secure data across cloud environments, maintaining control and data sovereignty.